Post contributed by Nestor Lovera Nieto, Part-time Research Scholar for the Economists’ Papers Archive and Visiting Scholar at the Center for the History of Political Economy.

The Jack L. Treynor papers are now open for research as part of the Economists’ Papers Archive, which is a collaboration between the Rubenstein Library and the Center for the History of Political Economy. Jack Lawrence Treynor (1930-2016) was a white American economist who was born in the railroad town of Council Bluffs, Iowa. He graduated with a bachelor’s degree in mathematics from Haverford College in 1951 and a Master of Business Administration (with distinction) from Harvard Business School in 1955. Between these two degrees, he was drafted during the Korean War and served for two years with the US Army Signal Corps in New Jersey.

Treynor was one of the first to explore the capital asset pricing model (CAPM) in “Market Value, Time, and Risk” in 1961. Although part of this writing was not published until 1999, it was mimeographed and widely circulated throughout the profession by colleagues who recognized its value. In fact, some of Treynor’s colleagues speculate that had he published his work on CAPM, he might have been a Nobel Prize laureate. In 1990, William F. Sharpe was awarded the Nobel Memorial Prize in Economics for his role in developing CAPM, which he had done independently of Treynor around the same time and published in 1964.

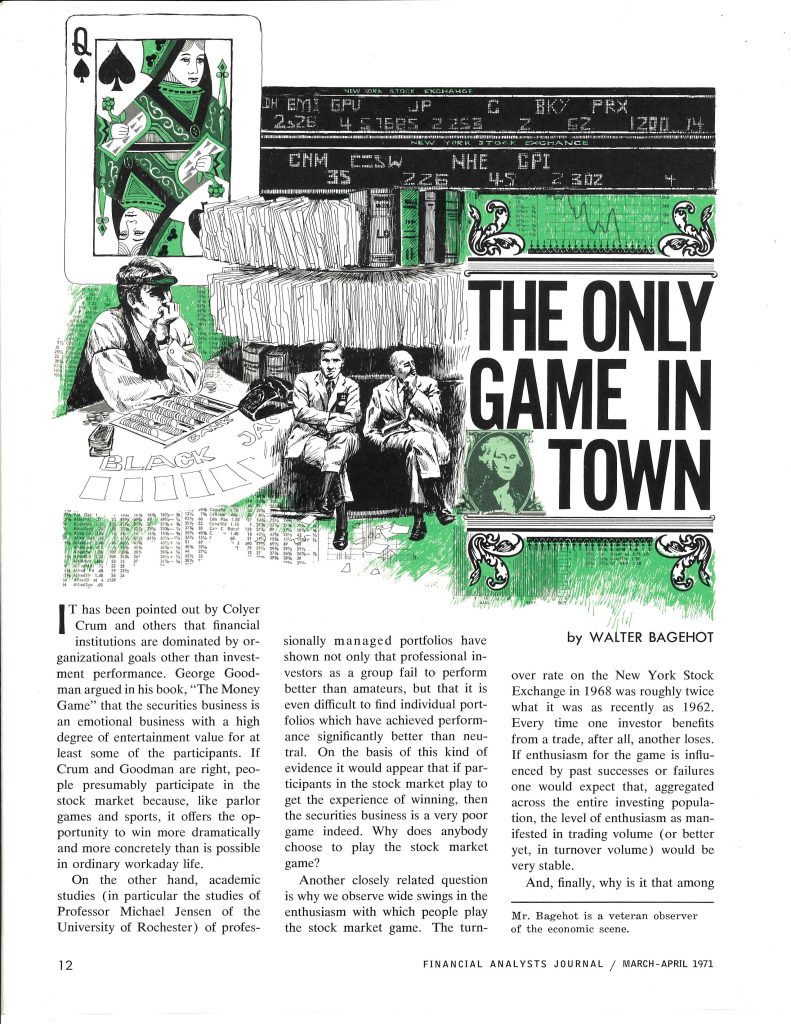

Treynor not only published under his own name but the names of two notable 19th-century economists: Walter Bagehot and Alf(red) Marshall. In fact, one of Treynor’s most cited articles, “The Only Game in Town” (1971), was written under Bagehot rather than Treynor. His motivations for using these pseudonyms and why he specifically chose these two remain a mystery yet to be unraveled.

The material in this collection came from Treynor’s home, which doubled as his office for Treynor Capital Management (TCM) after it was established in 1985, and two women from his family directly supported his professional career. His wife Elizabeth “Betsy” Treynor served as TCM’s administrative assistant and played a significant role as the creator or co-creator of many records, including most of the electronic ones. Additionally, there are printouts of emails intended for Jack but addressed to Betsy, with her responding either on his behalf or in her own capacity.

His daughter Wendy Treynor, who double-majored in economics and mathematics before pursuing a career in social psychology, annotated drafts of articles and conducted regression analysis.

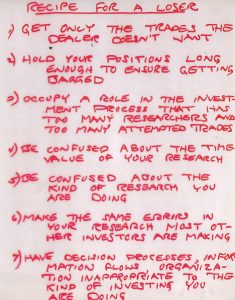

One unique aspect of this collection is the abundance of handwritten items, including over 50 letter-size notepads and hundreds of transparencies (the originals of which have been photocopied and subsequently discarded; preservation photocopies have been retained in the collection).

Unlike most other economists represented in the Economists’ Papers Archives, Treynor was not a lifetime academic, having spent only 1985 to 1989 as a visiting professor at two institutions. Instead, his day job was as a financial analyst, with his research and writing on the side.

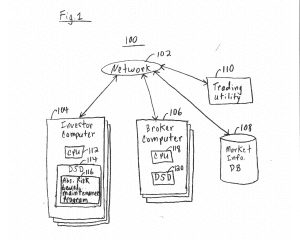

Treynor made significant contributions to the field of financial analysis, such that his peers in professional associations recognized him as having “changed the direction of the profession.” Demonstrating his innovative spirit, Treynor also registered a patent in 2004 for a “Method for maintaining an absolute risk level for an investment portfolio.”

Although the above diagram might leave us scratching our heads, it is undeniably cool because it is so well-drawn. Speaking of cool, Treynor was also an avid model train collector and layout builder (a nod to his hometown roots) and enjoyed writing plays in his spare time.

One thought on “Jack L. Treynor Papers Open for Research”

Comments are closed.